- Textile Sector- India & Punjab Overview

- Indian Textile Industry at a glance:

India is an important country of the world when it comes to the Textiles Sector. India ranks 2nd in production of Man-Made Fibres (MMF), 3rd in the exports of Textiles and Apparel[i], and is one of the two largest producers of cotton in the world[ii]. Out of total number of registered/ organized manufacturing factories in India, 7.22% (3rd most) belonged to Textiles Sector. Also, out of total number of persons engaged in registered/ organized manufacturing sector, 9.64% (2nd most) belonged to Textiles Sector[iii]. The Indian Textile industry is predominantly focused on cotton, which also happens to be an important cash crop in the country because of its role in the manufacturing industries and the overall economy of India. Due to its economic value in India, cotton is also termed as ‘white gold’.

Textiles Sector contributes massively to the exports of the Country. On an average, India exported Textiles and Apparels (including Handicrafts) worth more than $37 billion every year[iv] in the last seven years. The domestic apparel & textile industry in India contributes approximately 2% to the country’s GDP, 7% of industry output in value terms. India holds 4% share of the global trade in textiles and apparel. The share of Textiles and apparel in overall export basket of India was 10.33% during 2021-22[v].

- Textile Sector- Punjab Overview:

Textile is one of the top sectors that make up the Manufacturing ecosystem in the state of Punjab. Along with Food Products, Textiles and Wearing Apparel account for close to 31% of the Gross Value Added[vi] in the Manufacturing Sector. See table below for an overview of sub sectors comprising the Manufacturing Sector of the state. Also evident from the table is the fact that the Per Factory Profit is the highest for Textiles factories in the state.

Table 1: Performance on select indicators of registered manufacturing industries in Punjab 2021-226

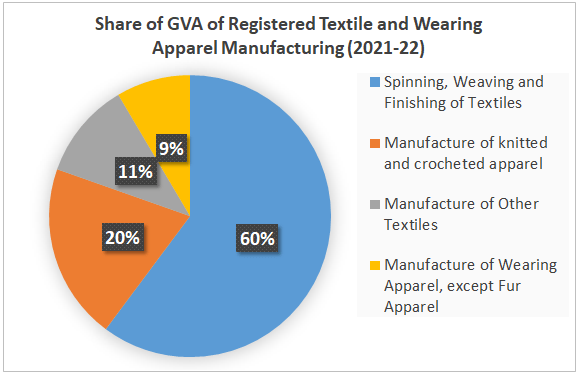

The availability of rich resource base and robust spinning capacity make the textile industries a major contributor to the output of the State of Punjab. Below pie charts show the share of GVA of Registered (Figure-1) and Unregistered (Figure-2) Textile and Wearing Apparel Manufacturing units.

Figure-1: Share of GVA of Registered Textile and Wearing Apparel Manufacturing Punjab 2021-226

Figure-2: Share of GVA of Unregistered Textile and Wearing Apparel Manufacturing Punjab 2021-226

As evident from the above charts, Spinning, Weaving, and Finishing contribute the largest value share in the registered space, whereas Manufacturing of Wearing Apparel (except Fur apparel) contribute the largest value in the unregistered space. It also comes to light that the Manufacturing of Apparel largely is unorganized. This presents problems in achieving scale and, as a result, the manufactured products are priced higher. This scenario decreases the competitiveness of the State. Moreover, lack of scale may lead to non-compliance with international standards and thus reduce the competitiveness of the State of Punjab further.

Let’s now analyse past year’s trade data in the context of Indian Textiles. The Table-2 below shows the trade balance of Textile raw materials and products. Note that Leather items are excluded from the table.

Table-2: India’s Textiles (excluding Leather items) Trade Balance for the period Apr-2023 to Mar-2024

Table-2 above offers some crucial insights regarding import-export of Textiles in India. We can see that Manmade Staple Fibres are not produced enough to meet the demand of textile manufacturers in the country, and so, there is a scope of augmenting the production of Manmade Staple Fibres in the country. For Cotton Yarn, we see that though we export huge quantities of cotton, we also import some. It may be the case that some varieties of cotton are in short supply in the country, which are imported to meet the demand. We see a huge deficit in trade when it comes to Other Textile Yarns, Fabric Made Up Articles. Since this head contains multiple items, a detailed analysis of the individual components is required, but what is quite evident from this data is the fact that we are not exporting much of the high value items that make up this head. If India is to increase its export value in Textile, then this head of Other Textile Yarns, Fabric Made Up Articles must see increased exports. Jute Fabric and Jute Yarn, even though imported in large quantity by the country, are one of the least expensive items. So, it is better to concentrate on other high value items for our analysis.

- Punjab vs Other States

Let us now compare how the top textiles exporting states of India fare in comparison to Punjab:

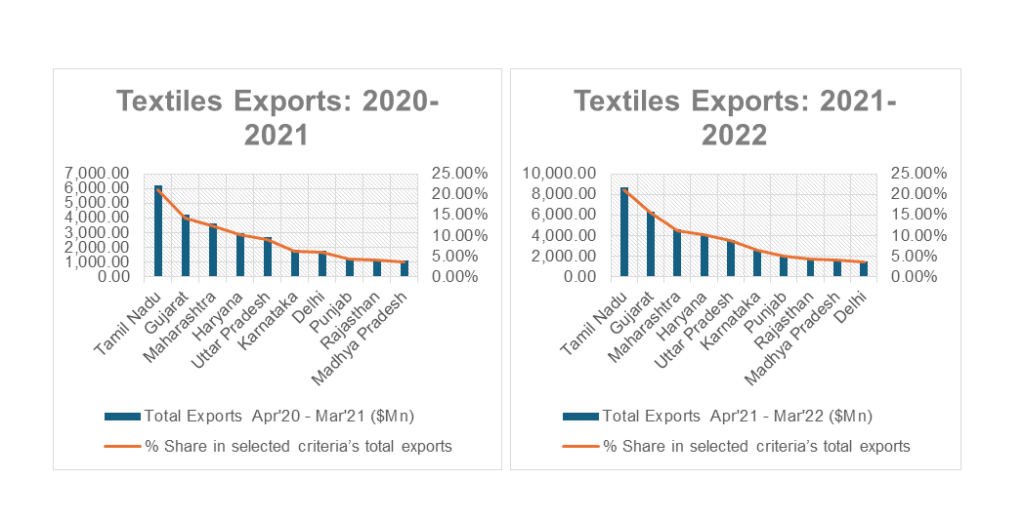

Figure-3: Yearly Textiles exports (in value, $Mn) from the top ten Indian states 2020-2024[i]

It is quite evident from the above graphs in Figure-3 that Punjab, since 2020, has not managed to touch 5% of India’s total exports (in value).

2. Strategies for the Growth of the entire Textiles Sector in Punjab

There are many strategies that could be followed to bring the Textiles Industries in Punjab among the top textiles players not only in India but also in global Textile trade ecosystem. However, financial constraints restrict the extent to which we can push on with these strategies. To have the greatest possible impact in the medium and long term, the following strategic initiatives could be undertaken:

- Achieving Scale across industry:

The Textiles Sector in Punjab, and largely in India, is highly fragmented across the value chain. Small scale industries with lower production capacities find it difficult to achieve economies of scale, which puts them behind the large industrial players of other countries like Vietnam, Bangladesh and China. Look closely at Figure-2 again: Manufacture of Wearing Apparels except Fur Apparels contributed 66% of the GVA added in Unregistered Textile and Wearing Apparel Manufacturing sector in Punjab in 2021-22. Now, look at Table-1 again: whereas Textiles contributes 13%, Wearing Apparel contributes only 5% of GVA of the registered manufacturing sector, even though the share of Textiles is 5% and that of Wearing Apparel Manufacturing is 7% in the Number of Operational Factories in the State. This clearly reflects the unorganized/ unregistered nature of Wearing Apparel Manufacturing subsector in the state of Punjab. Small, outdated units struggle with high production costs and inferior quality, which puts these units at a disadvantage versus international competitors. Also, achieving a higher level of Quality Control and Quality Assurance (QA/QC) is much more feasible for large setups. Therefore, consolidating the existing small-scale manufacturers into larger entities might just provide a scale at which production capacity and profits both multiply.

- Invest in R&D and Modernization[i]:

In today’s day and age of “Fast Fashion”, being always ready for the market demands is a huge advantage. But for that, Research & Development of new fabrics, products, and processes is a must! Also, Indian Textile sector is dominated by cottage industries and unregistered Textiles players who operate at small scale with quite obsolete technology. To take leaps in the Textile Sector, India, and Punjab in particular, must modernize such players at the earliest.

- Focus on High Growth Sectors and Products across value chain – Technical Textiles, Coats & Suits

For both domestic and international markets, it seems that the product mix that India (and as an extension, Punjab) has to offer is not completely compatible with what the world wants. Look at the Figure-5 below which shows the import of Textile items in India from few select countries:

Figure-5: Textiles import by India from select countries and the world between 2017 and 2022

As we can see, the total imports of Textiles by India have been consistently rising. This is mainly because certain niche products, that are not manufactured in Punjab and India on a large scale are required at a large scale. Some of these items are Jackets, Suits, Technical Textiles etc. By focusing on such high value and high demand products, exports and imports’ substitution can be achieved

Also, it is important for textiles industries to gradually move away from cotton products for exports and start focussing on synthetic garments, as these are preferred in developed countries.

Man-Made Fibre and garments hold huge exports potential. We should focus dedicate good amount of our efforts in developing these for exports.

Technical Textiles as a subsector of Textiles sector might just be the thing that can launch the Textiles Industries to a path of high growth. The Government of India is putting a lot of emphasis on Technical Textiles to achieve high exports and imports’ substitution.

References:

[1] Ministry of Textiles’ (GoI) Annual Report 2022-2023

[1] Ministry of Textiles’ (GoI) Note on Cotton- (Link)

[1] Annual Survey of Industries 2021-2022

[1] Ministry of Textiles (GoI): India’s Export (Principal Commodity wise) in the last 7 years- (Link)

[1] Ministry of Commerce and Industry (GoI), Department of Commerce: EP-Textiles Coordination Division- (Link)

[1] Economic Survey of Punjab- 2023-24

[1] DGCIS Export-Import data for the period Apr 2023 to Mar 2024

[1] NIRYAT: National Import-Export Record for Yearly Analysis of Trade, GoI- (Link)

[1] “Modernization, indispensable for development of Textiles”- The Indian Textile Journal (April 6, 2020) – (Link)

[1] World Bank Data on Imports-Exports – (Link)

Written By: Bidesh Bose, Sector officer, Invest Punjab