India’s healthcare sector is undergoing a paradigm shift, emerging as one of the fastest-growing markets globally. Driven by demographic transitions, rising incomes, digital adoption, and government initiatives, the sector is projected to nearly double from $372 billion in 2023 to $638 billion by 2025. However, despite this staggering growth, the demand-supply divide remains one of the sector’s biggest challenges.

This writeup takes a comprehensive look at the current dynamics, unmet needs, evolving models of care, and the critical role of private capital in reshaping the future of Indian healthcare.

Macro Tailwinds Converging

India’s healthcare sector is uniquely positioned for exponential growth due to the convergence of key structural enablers:

| Tailwind | Impact |

| Demographics | Rapid population growth, ageing citizens, and urban migration |

| Digital Penetration | Telemedicine and healthtech expansion |

| Policy Support | Ayushman Bharat, PLI Scheme, PM-ABHIM, Health Infra Mission |

| Private Capital Access | $30+ Bn in deals (2014–2024); 26% of Asia-Pacific PE volume in 2024 came from India |

| Global Shifts | Rising medical tourism, diversified supply chains, and investment realignment from China |

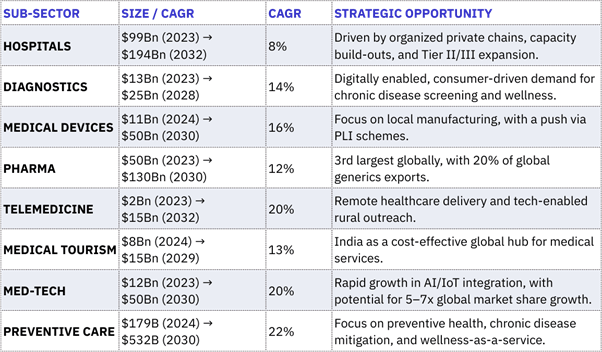

Sub-Sectors Poised for High Growth

| Sub-Sector | CAGR Outlook | Key Opportunities |

| Med-Tech | 30%+ | Diagnostic devices, surgical tools, AI integration |

| Telemedicine | 28% | Remote care platforms, Tier II/III outreach |

| Single-Specialty Hospitals | 20%+ | Oncology, nephrology, mother & child—low CapEx, faster ROI |

| Diagnostics | 15-20% | Preventive care, real-time screening |

| Health Insurance | 25% | Driven by policy reforms, employer-led programs |

The Indian Healthcare Market: Poised for a New Era

Explosive Growth Trajectory

- The sector’s expansion from $110 billion in 2016 to $372 billion in 2023 represents a CAGR of over 22.5%.

- This growth is fuelled by:

- An aging population: By 2030, over 12% of India’s population will be aged 60+, increasing demand for chronic and elderly care.

- Urbanization: Over 40% of Indians are expected to live in urban areas by 2030, increasing demand for quality urban healthcare.

- Rising non-communicable diseases (NCDs): NCDs account for 63% of all deaths in India, necessitating long-term specialty care.

Government Push

- Ayushman Bharat PM-JAY is the world’s largest public health insurance scheme, covering 550 million people.

- Digital Health Mission is digitizing patient records and enabling interoperability across platforms.

- The PLI Scheme for Medical Devices and FDI liberalization have spurred manufacturing and foreign investment.

Bridging the Infrastructure Gap: The Demand-Supply Divide

India’s healthcare infrastructure, though improving, still lags significantly:

| Metric | India (2023) | WHO Recommended |

| Hospital beds per 1,000 | 1.6 | 3.0 |

| Doctors per 1,000 | 0.7 | 1.0 |

| Nurses per 1,000 | 1.7 | 3.0 |

Projected Requirements by 2034:

- 9 million hospital beds

- 2 million additional doctors

- 3 million more nurses

To achieve this, India would need to build over 1,200-bed hospitals every month for the next 10 years — a mammoth task requiring capital, skilled professionals, and infrastructure reforms.

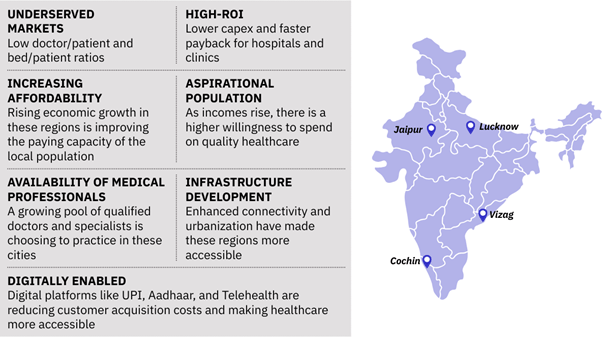

The New Growth Frontiers: Tier II and III Cities

Historically, Tier I cities like Delhi, Mumbai, and Bengaluru have attracted most healthcare investments. But now:

- 50%+ of new demand will arise from Tier II/III cities by 2030.

- Cities like Lucknow, Indore, Vishakhapatnam, Coimbatore, Jaipur, and Mohali are becoming healthcare investment magnets.

- Land and labor costs are lower, while demand for services is rising due to aspirational middle classes and improving connectivity.

Case Example: Mohali Medicity, Punjab

- Located in a high-potential zone near Chandigarh, Mohali Medicity is a multi hundred-acre planned medical hub, attracting investments from hospital chains, diagnostics, and med-tech companies.

Affordability Challenge: India’s High Out-of-Pocket Spending

India has among the highest out-of-pocket (OOP) expenditures globally:

- Nearly 48.2% of healthcare spending is paid directly by individuals.

- In contrast, the global average is 18%, and in countries like the UK (NHS model), it is less than 10%.

- High OOP is a primary reason for 63 million Indians falling below the poverty line every year due to health expenses.

How to Tackle This:

- Expand insurance penetration beyond Ayushman Bharat.

- Encourage low-cost health fintech and savings plans.

- Incentivize hospitals to adopt differential pricing for lower-income patients.

Evolution in Delivery Models: New-Age Healthcare Infrastructure

Traditional full-service hospitals are:

- Capital-intensive (₹5–7 crore per bed),

- Slow to scale, and

- High in break-even time (5–7 years).

Emerging Models:

- Single-Specialty Chains (e.g., oncology, nephrology):

- Faster RoI, scalable across geographies, leaner operations.

- Examples: HealthCare Global (HCG), NephroPlus

- Day-Care Centers:

- Popular for cataracts, minor surgeries, dental, dermatology.

- Quick turnaround and low infrastructure costs.

- Franchise-Based Networks:

- Diagnostic chains like Dr. Lal PathLabs, Thyrocare, and primary care models like Clinics by Max, enabling rapid national rollout.

- Digital & Telemedicine Models:

- eSanjeevani (National Telemedicine Service): Over 130 million consultations to date.

- AI-based triage, virtual ICU monitoring, and remote diagnostics are enabling tier III care access.

Private Capital: Catalyst for Transformation

Even with policy support, India cannot bridge the healthcare gap without private capital.

Investment Trends:

- 2023: Private equity & VC inflows were $1.55 billion — lowest since 2020, due to macroeconomic headwinds.

- Key players include:

- Quadria Capital: Closed a $1 billion fund, plans to deploy 60% in India, focusing on diagnostics and mid-sized hospital chains.

- Temasek, General Atlantic, and TPG Growth have backed hospital chains like Manipal, Medanta, and Aster DM.

Why India Attracts Investors:

- Underpenetrated Market: India has only 1.5 beds per 1,000 vs. 12+ in Japan.

- Strong Consumption Trends: Indians are now spending more on preventive and wellness services.

- M&A Opportunities: Many family-run hospitals are seeking exits or partnerships.

- PPP Models: Several states are launching hybrid public-private health projects in diagnostics, dialysis, and trauma care.

Why Punjab is the Next Big Healthcare Destination – A Strategic Investment Table for Hospital Chains

| Category | Punjab Advantage | Strategic Benefit for Hospital Chains |

| Population & Demand | Multi crore population with high prevalence of NCDs and aging population | High patient footfall and long-term service demand |

| Per Capita Income | Among highest in non-metro North India | Higher affordability for quality healthcare |

| Hospital Beds per 1,000 People | Below national average of 1.7 and WHO’s 3) | Massive supply-demand gap, signalling opportunity |

| Doctor-to-Patient Ratio | Below global average | Opens scope for multi-specialty and single-specialty expansion |

| Medical Education Infrastructure | Over 10,000+ doctors, nurses, and paramedics graduating every year | Ready pool of skilled and affordable workforce |

| Existing Healthcare Infrastructure | Concentrated in cities like Mohali, Amritsar, Ludhiana, Jalandhar | First-mover advantage in underserved Tier II/III towns |

| Tier II/III City Potential | Cities like Bathinda, Hoshiarpur, Sangrur, Mansa emerging as healthcare frontiers | High ROI and rapid patient acquisition |

| Medical Tourism Potential | Diaspora traffic from UK, Canada, Australia; patients from J&K, HP, Rajasthan | Natural footfall for elective procedures and specialty care |

| Flagship Projects | Medicity Mohali (100+ acres) | Pre-approved land and integrated ecosystem for hospital chains |

| Policy Incentives | Investment subsidy, electricity duty waiver, stamp duty exemption etc. among others | Reduces capex and improves viability |

| Ease of Doing Business | Invest Punjab one stop office with <45-day approvals | Faster turnaround from proposal to operations |

| Cost of Operations | 25–30% lower than NCR, Mumbai (land, manpower, utilities) | Better margins and lower break-even timeline |

| Existing Private Players | Fortis, Max, Paras, Grewal, Homi Bhabha, Chaitanya, IVY already operating | Validated ecosystem and patient traction |

| PPP Opportunities | Government support for diagnostics, dialysis, cath labs, telemedicine | Revenue assurance and semi-public demand pipelines |

| Med-Tech & Pharma Base | Medical Devices (Rajpura), Biotech hubs (Mohali, Ludhiana) | Vertical integration for backend and supply chain |

| Connectivity | Excellent road, rail and air links (Amritsar, Mohali etc airports) | Ensures patient inflow from adjoining states |

| Digital Health Push | e-Sanjeevani, Ayushman Bharat, public-private tech pilots | Platform to build hybrid online-offline care models |

| Public Sector Coordination | Proactive Industry Dept, Health Dept, Invest Punjab handholding | Ease of land acquisition, policy clarity, grievance redressal |

| Future Outlook (2025–2034) | 9 million beds & professionals needed across India | Punjab poised to be a scalable, high-impact zone for expansion |

What’s Next: Key Imperatives for the Future

To build a more equitable and efficient healthcare system, India must:

- Boost Health Financing: Raise public health spending from 2.1% of GDP to at least 2.5% by 2025 (as per National Health Policy).

- Address Human Resource Gaps: Incentivize rural medical practice, expand nursing colleges, allow task-shifting through community health workers.

- Encourage Innovation: Support health-tech startups through regulatory sandboxing and funding.

- Promote Medical Tourism: India’s cost advantage (65–90% lower than developed countries) makes it attractive for fertility, orthopedics, and cardiac procedures.

Conclusion: A Sector on the Cusp of Transformation

India’s healthcare sector stands at a defining moment. With growing needs and an evolving delivery landscape, the path forward must be inclusive, scalable, and financially sustainable. By channeling private capital, rethinking care models, investing in human resources, and bridging infrastructure gaps, India can not only meet its domestic health demands but also emerge as a global hub for affordable and innovative care.

The journey ahead is challenging, but the foundation is strong. With the right blend of policy, capital, and innovation, India is well-positioned to bridge the demand-supply divide in healthcare and ensure “Health for All” becomes more than a vision — it becomes reality.

References: