Couple of months back, I had written a blog on How the fiscal imprudence of the US government has led to the Debt ceiling crisis. So, as I write this blog, there is already news that Fitch (credit rating Agency) has downgraded the credit rating of the US government long term bonds from AAA to AA+.

For those who don’t know, the credit ratings are like your CIBIL credit scores, the lower the rating, the Higher the risk of default so, the borrowing comes with a risk premium. Losing the AAA rating further removes US from a small group of countries that still maintain the Top-Notch rating from all the three major agencies. The group of 9 are Australia, Denmark, Germany, Luxembourg, Netherlands, Norway, Singapore, Sweden, and Switzerland. For these countries to have such high ratings the following conditions must be fulfilled.

1. Stable balance sheet

2. Good Governance

We all know what has happened with the debt ceiling in past months, so it comes as no surprise to most.

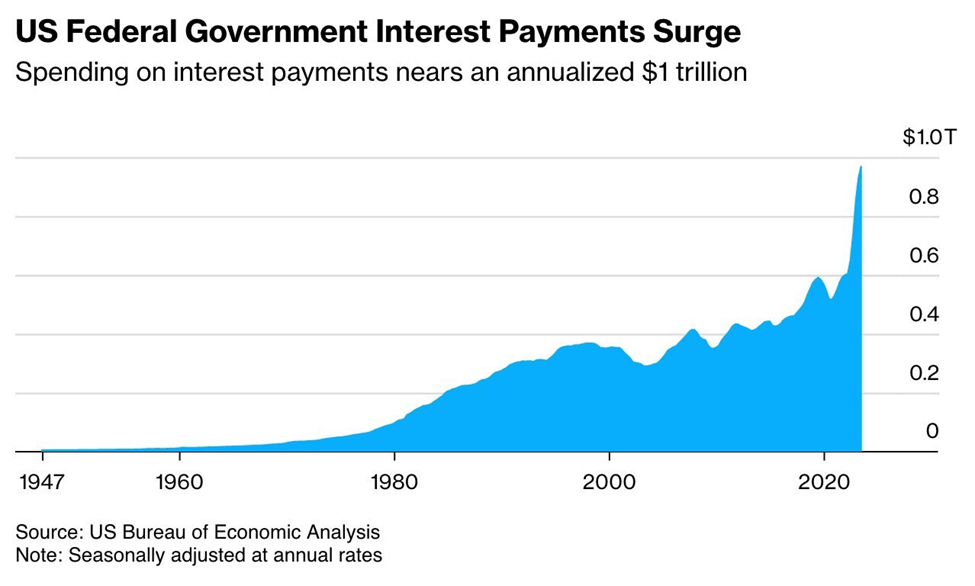

There are concerns with the fiscal policy, which is putting the US in decline. Just look at the graph below, it shows the federal government must pay on an annualized rate about $ 1 trillion in interest (Coupon) payment for the next year.

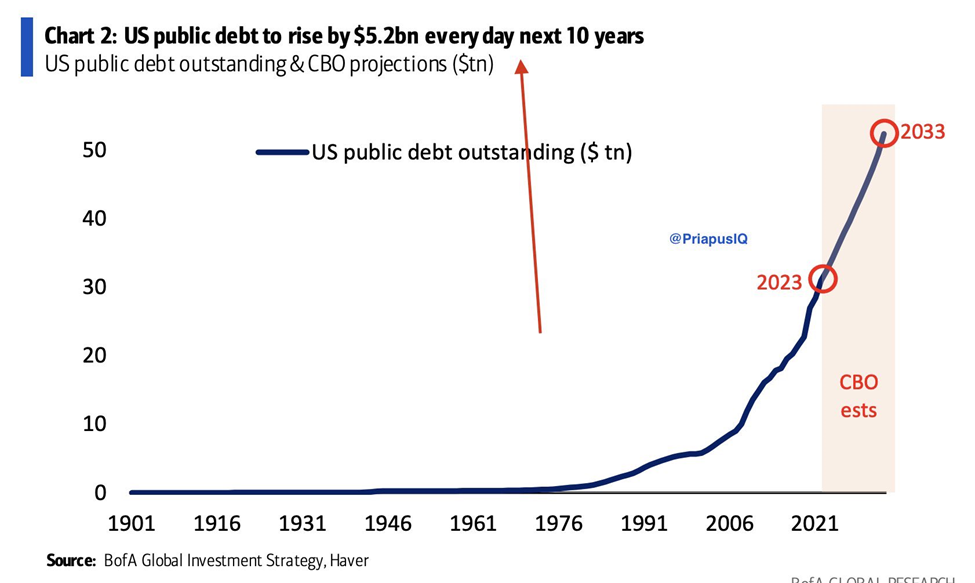

Not only that, but this public leverage will also keep on increasing more than a 5 billion dollars year on year basis. By 2033, US debt is projected to hit a record $50 trillion. Over 20% of government revenue will go toward interest expense ALONE.

So, this now is becoming a size able part of US budget, paying interest in the debt is larger capital for government than defense spending.

Short term impact on bond markets:

The chart shows the impact these downgrades have been on the long-term treasury yields, because of the downgrade people have sold off their 30-year T bill etc., which has led to increase in the treasury yields.There has been more than 10 % decline on the mark to market basis. This is not good for small banks which are holding deposits in these long-term instruments, which are generally considered safe.

People are moving money from banks to money market funds due to high interest rates.

This means banks will have less money to lend and they will be more careful with who they lend to.

Bill Ackman, the famous hedge fund manager, Is now shorting these government bonds. He thinks the yields will further go down to even 5.5%, which is currently sitting at 4.3% . There are two prominent economists have said that US will have 5% or more rates for long term bonds for large amount of time in future.

The above report is made by treasury borrowing advisory committee of US. It says that in past years the 2-years T Bonds rate has increase by 100 basis points and 10-year Bond rate has increase by 40 Bps.

The Holdings of Banks have non-Mortgage-backed government securities have currently declined by almost $635 Billion since peaking in 2022. That means are selling off their treasuries.

The report mentions that treasury supply will have to be increased to address the fiscal deficit. The tax revenue has become weaker, and spending has increased. That means treasury must sell almost 2 trillion dollars’ worth of Bonds in the next two quarters to pay bills. This is perfect manifestation of debt spiral.

Social Security: The necessary EVIL ?

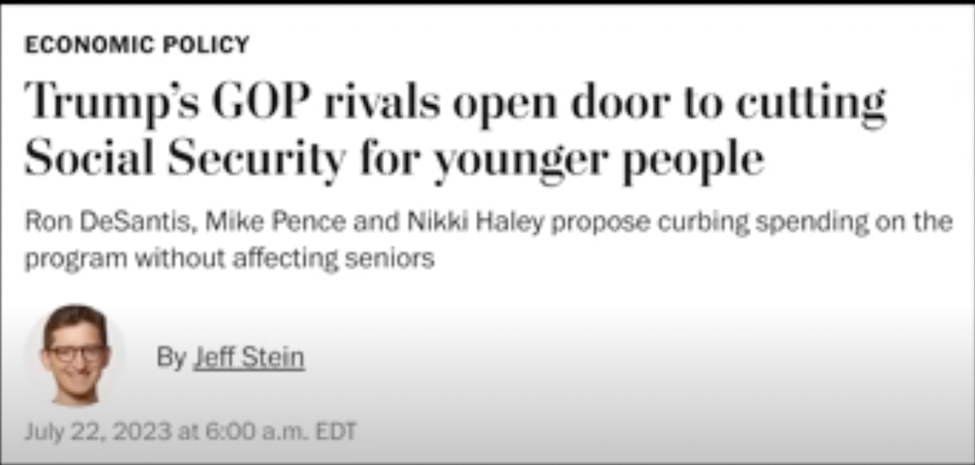

Currently a larger portion of spending of the US government goes in the social security. If you have noticed what’s happening in the current election campaign, you would know that its becoming a hot topic of discussion. The republicans are asking for spending cuts on the social security.

DOWNGRADE OF 2011 of US Debt

What was the impact of the 2011 credit ratings downgrade risk assets?

If we look at the history of the sovereign ratings in the US, we can see the last time the US received downgrade in the credit ratings was in 2011 by S&P. The economy was coming out of the aftershocks of the global financial crisis, but still S&P index was trading sideways.

Perhaps some solace can be found in looking at what stocks did the last time this happened. S&P downgraded the United States’ credit rating on August 5, 2011. The broader market was volatile, trading mostly sideways for the next couple of months, until it bottomed in early October. The S&P 500 lost about 8% over that time period.

Have a look at where the market stood six months after the downgrade and you’ll see a much more hope. The S&P 500 was up about 12% on a price basis at that point. One year after the downgrade, the market had galloped on 16%.

Ideally, S&P should have fallen, because the risk premium would have increased BUT It didn’t happen, may be because the fed was in the mode of increasing economic activities in the country so , the investors didn’t take the downgrade that seriously. However , Going forward because of the strong labour markets and high interest rates , this might not be case this time.

What happened in the Bonds and Bills Markets in 2011?

Well, this where normal logic takes a hit , if there is a downgrade normally , T bill holders ( who are not holding these bills for maturity ) will start to sell the bills, but exactly opposite happened. More and more people started buying T bills.

Why ?

Because it’s the US . The strongest currency in the world . Most Risk investors instead of betting on other assets thought that risk is way lesser in the T bill yet .

Secondly let’s see what the market were going into when the downgrade happened in 2011 and what is happening now.

| Downgrade | S&P | Fitch |

| When | Aug 5, 2011 | Aug 1, 2023 |

| Nifty YTD | -13% | 9% |

| S&P 500 YTD | -4.6% | 19.2% |

| Nasdaq YTD | -3.6% | 36.5% |

If you look at the table , above the time metrics for market data , the downgrade in 2011 came when the market were down already and even then , within few months the market picked up .

But is highly unlikely that this behaviour of the market will be repeated . The FED needs to bring the sticky core inflation down. Secondly , the US is up for elections , It won’t Bothe well for the Democrats to see high interest rates killing people’s living standards . It’s a rock and hard place kind of situation for the government here.

What is reason with such bad governance of the US ?

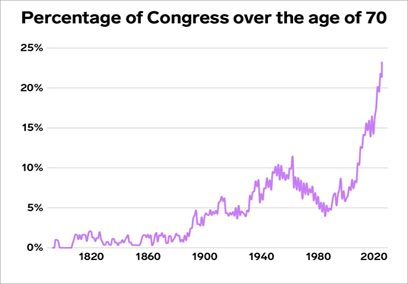

One thing one should think about it , how tied is the US’s fiscal spending problem to the age of the congressmen in the US government. IF you think about who is young , they will invest for the future else If you are someone who is old , you would live for the day and you don’t think about future much. The ageing of establishment that makes the decision of how money is spent creates psychological barrier . I mean there is no incentive for these old congressmen to think about the future innately . They think about giving the money today instead of using it to have a prosperous tomorrow. If you a 20 year old in charge of some of the fiscal policy , environmental policy, energy policy decisions , it would be a different set of decision making , then someone who is in their 80 s.

Is the printer coming?

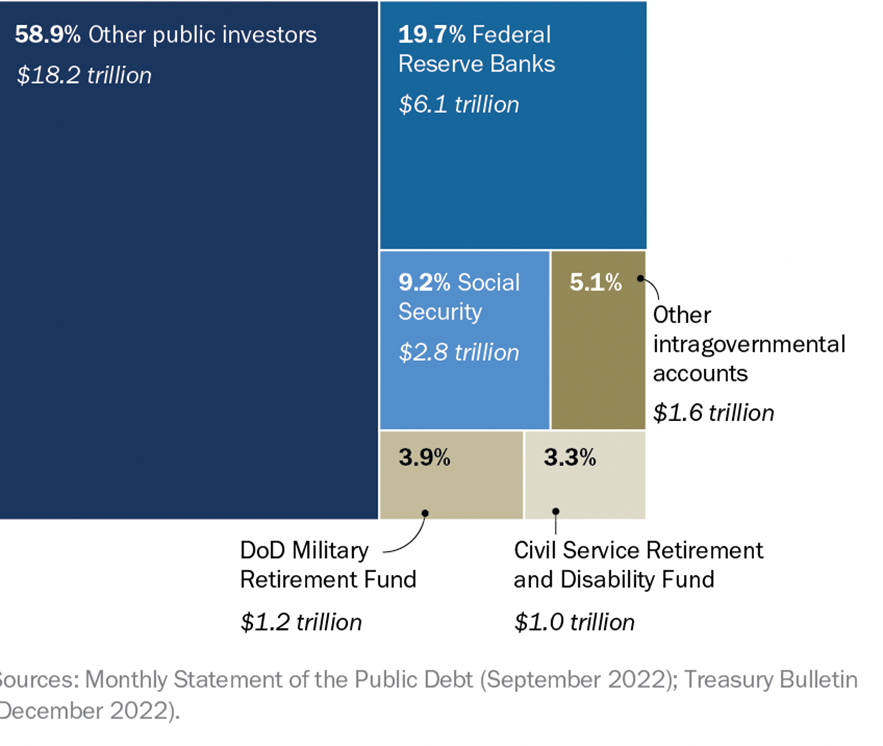

Not for now. The demand of treasury Bills are relatively high among the investment funds, the yield is high so for funds which are long term will continue to hold these bonds. However , going forward, as the supply keeps coming at the rates mentioned above , the FED will need to do quantitively easing(QE) and more freshly minted money will be thrusted in the market . The pic below shows that 20 % of bills are owned by FED , so if the demand shrinks because of too much supply , Printer could be called back again .

Written By: Ankur Kushwaha, Sr. Consultant, Invest Punjab | Govt. of Punjab.

DISCLAIMER: Views expressed are personal.