In the dynamic landscape of Indian states vying for increased capital expenditure and foreign direct investment (FDI), a strategic approach often involves engaging with the High Commissions of respective countries within India. This approach offers a cost-effective alternative to the traditional method of dispatching extensive teams overseas, allowing for focused interactions with ambassadors who are already acquainted with the economic pulse of the states in india .

The conventional preparation for such meetings typically involves state Industrial Development Bodies collaborating with renowned consulting firms. This collaboration aims to craft detailed proposals for various countries, encompassing key facets of potential collaboration. These often include highlighting the quantum of FDI from a specific country, identifying sectors ripe for investment – with a focus on those with robust means of production, outlining incentives aligned with state industrial policies, and referencing historical import-export data. Additionally, showcasing major companies from the visiting country serves to underline existing collaborations and opens avenues for further investment.

Engagement of Ambassadors in Presentation:

However, the challenge lies in presenting this information to ambassadors who, despite being government officials, may not be intimately familiar with daily economic intricacies. If the ambassador hails from a developed country, the gap in understanding may widen further. Moreover, these ambassadors are accustomed to extensive presentations, often bordering on promotional campaigns, leading to a sense of disinterest and boredom. Given their non-obligatory role in securing investments for your state, the challenge is compounded by their potential lack of accountability in this area to their home governments.

Furthermore, considering mostly ambassadors lack foundational knowledge in finance, economics, and business strategy as most of them are from regulatory background , merely presenting a list of sectors may fall short for a state government to expect their presentations in having a meaningful impact . Considering these challenges, the need arises for a more concise yet effective strategy to engage ambassadors and maximize the potential of such interactions.

Empathize with ambassadors :

From the ambassador’s perspective, a lengthy “ EDUCATIONAL SESSION” on trade , investments and commerce might prove counterproductive, as their primary interests and key performance indicators lie elsewhere. Thus, for the state and its advisors/consulting professionals , the imperative is to delve into a meticulous understanding of the targeted country’s economy. A systematic analysis of sectors and industries becomes pivotal, necessitating a comprehensive framework:

Consider – Australia

1. Understand the Driving Forces of the Target Country’s Economy:

Taking Australia as an example, recognizing major contributors such as mining, education, construction, and real estate provides a foundation. Look for the major Gross value adding sectors in Australia .

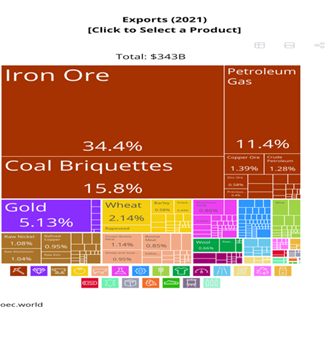

Major exports from Australia are Iron ore, Coal in goods and Education services . They form the major chunk of GDP of the country.

2. Examine Specifics within Each Sector:

Delving deeper into sectors, such as mining, entails understanding the composition of exports, like iron ore and coal. This insight informs targeted strategies for collaboration, such as facilitating the supply chain for steel and aluminum manufacturing in the state. If your state has potentially no way they can utilize these exports, then this part of economy of Australia basically becomes useless for your state to consider .

becomes useless for your state to consider .

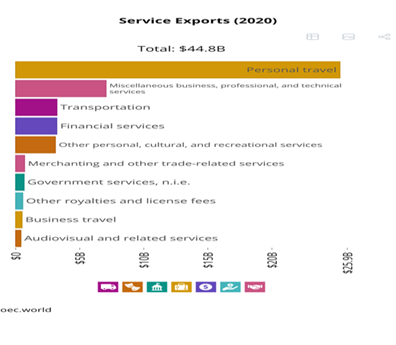

If you look at the second chart, the major exports are professional services which are majorly fee paid by students for universities , so what do we understood? the major exports are education services and coal and iron .

Next step Explore the Education Sector:

In the case of Australia, where education significantly contributes to the GDP, identifying key universities and their specialized programs becomes crucial. This knowledge enables the state to align its offerings with the needs of the knowledge-based industry.

If your state desperately needs good education colleges, because major skill-based industry aren’t investing in the state, you should prioritize as state which set of education Centre in Australia offering what courses should open their campuses in your state.

If recently held summit of a major state , only investment that came from Australia per say was a education institute

So, the low hanging fruits which makes sense for your state and Australia is Education sector ,because most Australian universities are still among the best in the world .

Analyze Trading Partners and Consumption Patterns:

Examining where Australia’s exports, such as iron ore and coal, are consumed, like in the Shanghai steel industry, guides the state in focusing on relevant areas, such as establishing educational institutions catering to the needs of that industry. The data for Exports in areas of Iron ore or Coal from Australia will tell you that most of that is consumed in the steel sector in China. And most of the Companies are based in Shanghai region, which is near the sea, so if your state has better way to procure energy for existing industries , there Is no synergy present in mining sector.

Check for Bilateral Investment Treaties (BIT) and Free Trade Agreements:

Evaluating whether a target country has a BIT or a free trade agreement with India becomes pivotal. The absence of such agreements could impact the willingness of foreign firms to invest. If you notice FDI inflows have reduced from countries because of this issue only, so keeping this in mind is also very import , the market opportunity and history of any unpleasant arbitration would also matter for companies to invest in your state.

In case you are targeting investments from emerging countries , these bilateral investment treaties would not have much impact but developed world would have much Impact . Investors must feel safe legally in your state and country .

Consider Geographical Proximity and Industry Norms:

The nexus between proximity and industry norms emerges as a pivotal factor shaping investment decisions within the economic landscape. Take, for instance, the scenario where a country, such as Vietnam, establishes a free trade agreement with India specifically in the auto sector. This strategic alignment prompts contemplation over the viability for an Original Equipment Manufacturer (OEM) to favor exportation over direct investment.

In evaluating the implications of free trade agreements(FTA) , a nuanced perspective is imperative. While such agreements hold the potential to facilitate economic collaboration, the proximity of countries and the homogeneity of product features demand careful consideration. There exists a scenario where, due to the geographical proximity and product feature similarity, certain products from specific industries might find exporting more economically prudent than establishing investments.

Hence, the intricate dynamics of free trade agreements render them a double-edged sword. On one hand, they present opportunities for streamlined economic cooperation, while on the other, they introduce complexities based on industry specifics and geographical proximity. Consequently, the effectiveness of engaging with a country under such agreements requires a meticulous analysis of the industry, considering factors like production efficiency, transportation costs, and the strategic advantage of exporting over investing.

In essence, the presence of a free trade agreement necessitates a nuanced approach for your state and country. It demands an astute evaluation of whether investment talks with the concerned country are aligned with the comparative advantage of your state’s industries. Acknowledging the intricate interplay of these factors is essential to harness the full potential of free trade agreements and ensure that they serve as a strategic boon rather than an unintended bane for your state’s economic objective.

Talking to ambassadors from EMERGING MARKET countries –

In case your state talks to an ambassadors of emerging country economy wise, Understanding the FDI patterns in emerging markets, like Malaysia, Indonesia or Thailand, guides the state in directing efforts toward countries that demonstrate significant investment potential.

Track the sector which are small now but growing very Fast :

Consider the case of Vietnam as a noteworthy example within the realm of emerging markets. Historically, its economic landscape has been dominated by the export of electronics, with Samsung emerging as a key player and one of the largest investors in the region. This scenario provides a unique opportunity to make a compelling case for attracting Samsung’s investments to your state, bypassing direct negotiations with Vietnamese government officials.

In the evolving landscape of the electronics industry, particularly with the growing prominence of electric vehicles (EVs), even major players like Foxconn are entering the EV sector. This shift opens the possibility of presenting a convincing case for Foxconn to source supplies from investors in your state, thereby promoting exports. Moreover, there is potential for Foxconn to consider investment opportunities within your state, strategically positioning itself within specific segments of the value chain.

By carefully analyzing the dynamics of the electronics industry and identifying the gaps or opportunities in the supply chain, you can articulate a compelling argument for Foxconn to explore partnerships or investments in your state. Emphasizing the advantages, such as a favorable business environment, skilled workforce, or logistical advantages, can strengthen the case and make it more appealing for Foxconn to consider your state as a strategic destination for its operations.

Trends of FDI in the emerging market country

A visual representation reveals the importance of focusing efforts on countries like Japan, the US, and Singapore instead of only engaging with Thailand, because most of FDI comes from these countries to an emerging market like Thailand.

Similarly , look for the sector which have received FDI and where are they based In that country . For example, in Vietnam below in last few months the following sectors have received FDI ,

It can be further drilled down in industries and then even the location where these companies are based in .

The above diagram shows the list of provinces the FDI is going into , If you drill down , it will tell you why these areas are getting investment and what industries are coming up , It will help you understand the what synergies can be found in your state and what not .

Give with one hand and take with the other.: What’s in it for the other country ?

Capital Outflow /Inflow management :

In case you are talking to ambassador of emerging market , the following MUST be taken care of. In return for asking investment in your state , consider reciprocating to the Ambassador also. The outflow of capital from their country will likely happen if investments flow into your state. Identify key industries native to your state, focusing not on global investors but on local ones with headquarters within your state. Engage these local players to explore new avenues for growth in the Ambassador’s country. It’s crucial to understand that the Ambassador is not solely seeking outward capital from industries but is also interested in fostering capital inflows. Mostly this should be taken care when you are talking to a ambassador of emerging market economy .

Lastly, but the most important thing, this is where the skills of the consulting firms, which are hired by the states’ investment bodies, will come into the picture. All the above economic research mentioned in the article should be distilled or dumbed down to give the following output, which is easily understandable and is very tangible in nature.

Tangible output of the meet with Ambassador : After the ambassadorial meeting, the state should promptly present a meticulously curated list of companies within each industry and sector of the country, complete with a well-crafted business case. This list should explicitly highlight companies that stand to discover significant value in the state, along with those in the state capable of expanding into the ambassador’s country through joint ventures, exports ,direct Investment or similar avenues. It is imperative to distill the information to its utmost simplicity, recognizing that the ambassador, or any senior official, is not tasked with conducting research and development for the state post-meeting – a responsibility that falls squarely on the state’s shoulders. Being thoroughly prepared with succinct business cases containing company names is paramount. Without such precision, any presentations or economic data shared during the meeting risk fading into obscurity. Hence, adopting a meticulous approach to industry analysis and comprehensive groundwork is indispensable.

Think like Ambassadors :

What you convey and desire is essential. Placing yourself in the ambassador’s shoes is crucial. Results will only emerge when you consider things from his/her perspective.

THE BOTTOM LINE : The success or failure of meetings like this depends on meticulous economic and industrial research done by the state. Finally, providing tangible requests to the ambassadors is crucial. Keeping things broad and vague may look good in pictures the next day in media/newspapers , but obtaining any tangible output becomes very challenging or next to impossible . It also depends on whether you are talking to the ambassador from an emerging economy or a developed economy , the Analysis will be different in both cases.

In conclusion, the art of engaging with ambassadors for investment promotion lies in precision, customization, and reciprocity. By tailoring proposals to align with the economic intricacies of the target country, states can transform these interactions into actionable plans that benefit both parties.

Written By: Ankur Kushwaha, Sr. Consultant, Invest Punjab | Govt. of Punjab.

DISCLAIMER: Views expressed are personal.