The bottom Line, the most important part of any functioning business, Profit after cost , expenses and taxes. The money that the founders and investors in company get to put back in the pocket for the risk and efforts they put in to a business, sounds like business 101 ? , It is actually kind of that only . A business that doesn’t profit is like a freezer that doesn’t make ice. It’s more of less pointless. So, why is it that some of biggest companies in India and rest of the world are not turning to profit. Why is it that they don’t even plan to? .

Why would anyone invest in a company that is unprofitable?

Why do these companies look to speculators like sold investments? Almost all businesses in the world start out unprofitable , over a period of time they develop their customer base . This is expected as a part of business life cycle. But, the big distinction is that most business will try to get to a point when they will break even . For people starting their own ventures , this a point where the new company investors or owner doesn’t need to contribute his own capital to keep the lights on. After the break even , the next Is turning to profit . For most business that do get to this point, they get to live happily ever after.

Some businesses continually grow because their model suits a grander scale of operation unlike running a coffee shop. To do this, this type of businesses will need to attract investors . because unless these hypothetical founders are extremely wealthy they will need to access large pool of cash , for developing new Uber or Ola Rival or Oil fracking operation . These funding rounds are normally done periodically when one or more milestones are achieved. Either the business grows and achieves a new goal like getting 50% market share in a new city or business runs out of cash.

Now investors are much likely to invest in a company that has hit growth goals than to invest in a company that is running low on cash . So, these companies develop a growth at all cost mind set. For all this is still actually fine , some business take more time to turn into profit than others and they need more cash than others. This actually becomes a game , then to just burn cash and grow revenue , get more valuation in the next round and past investors exit by making profits and new investors do the same with the next ones.

What is cornering is that some companies have no plan for profitability , they have all the market share they can ask for , then what gives , how can anyone make money of this sort of investment ?

This is because different rounds of funding attract different types of investors. Let’s say two friends develop a system to extract oil more efficiently, the part of cash will come from these founders only . After this , comes angles investors , which seek good ideas . Now, the actual product is rolled out. It will show more slightly conservative investors that this technology works, which is where the big guns will come out ( VC and PE funds ) . At this point the founders can look to raise capital from the next round of funding with companies in the industry and Venture capital firms.

What normally, happens is that founder will sit in the office and will be given a choice. They can now sell their own equity in the company; the cash will not go to the business operations but will instead into their own personal bank accounts. It helps the firms to buy company without diluting the ownership much, and it is good to have the founders of billion-dollar companies to look successful. More investors are not going to be attracted in the future and if founders are looking not so financially well , it doesn’t look good sight for the less sophisticated public .

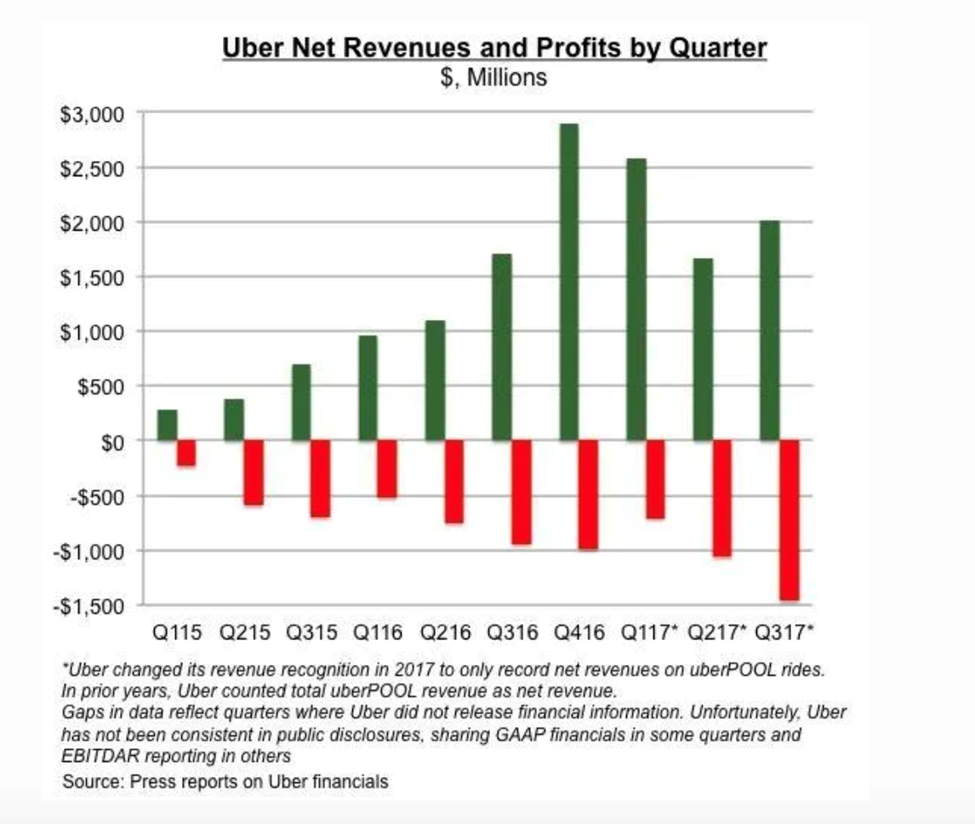

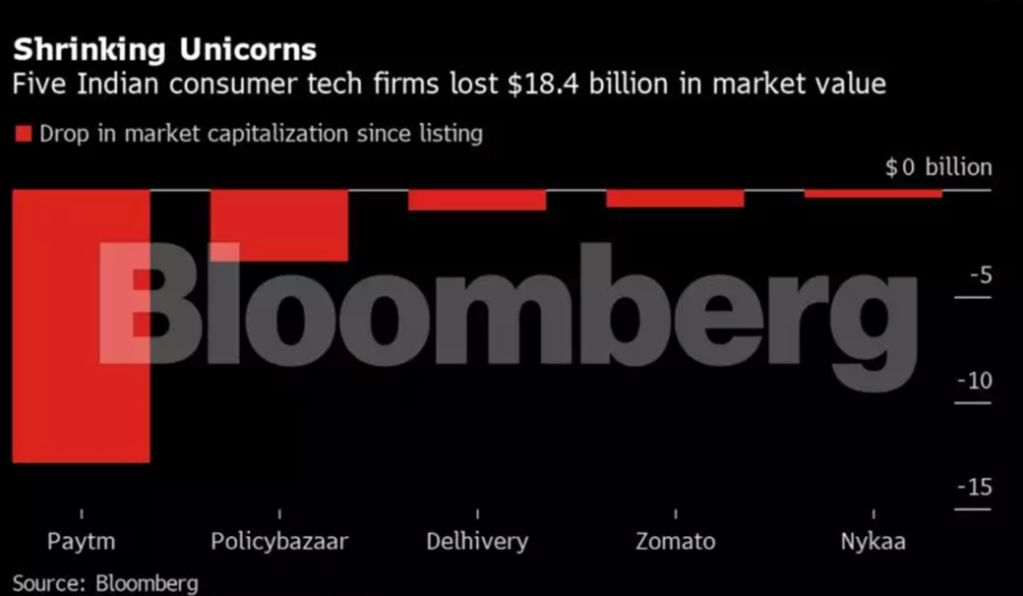

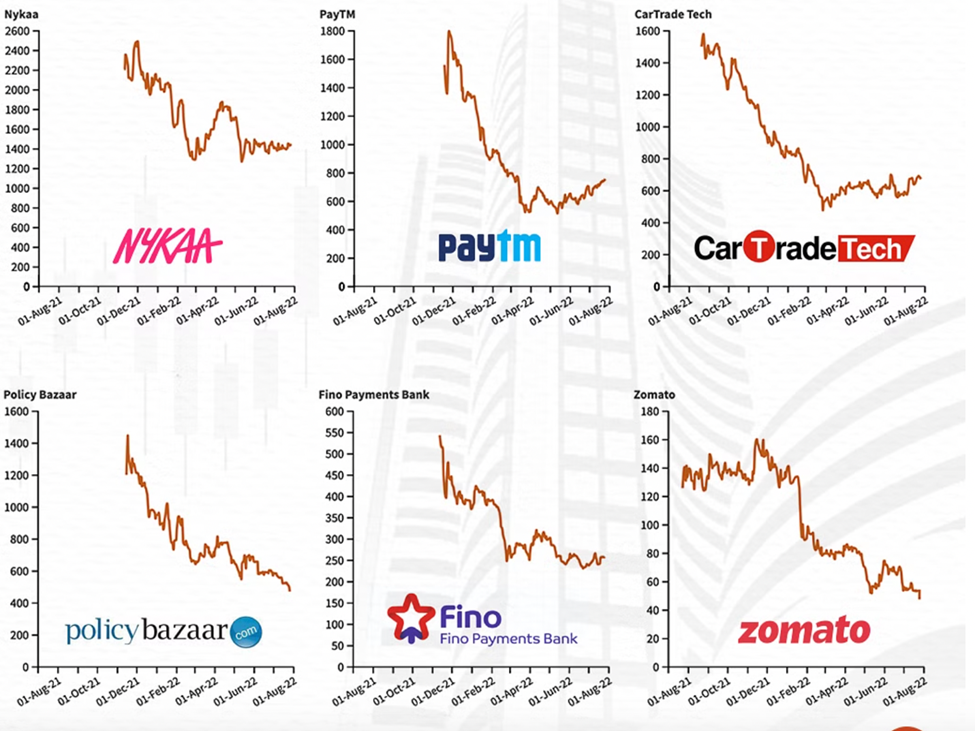

In the above-mentioned data, you can see some founders which run companies which have no path to profitability yet. They barely make profits or in some case no profits at all . For instance, nobody knows when they will make cash flows , even after IPO companies like Zomato and Nykaa are not giving much hopes in P&L Sheet .

So, the company repeats this process many times over in form of series A, B. C round of funding etc. . While doing that angel investor will cash out his shares, their money they can use for next company. This all is done for the holy grail of reaching to IPO,

Historically companies have been profitable when they get listed, however since 2019 most of them have been in RED.

Public offering is where these VC will cash out their shares and get do the whole thing with a new company .

Investor getting rich by attracting more investors who only get rich by attracting other investors , you might be thinking that hang on ! . Is it not a Ponzi scheme?. It really does look like that.

Technically the funds raised are used to fund and develop operations rather exclusively pay out all the investors.

Remember Theranos?

Elizabeth Holmes was very successful in securing funding from investors, but it was later discovered that she had lied about the technology and business transactions of her company.

Public offering is where these VC will cash out their shares and get do the whole thing with a new company .

Investor getting rich by attracting more investors who only get rich by attracting other investors , you might be thinking that hang on ! . Is it not a Ponzi scheme?. It really does look like that.

Technically the funds raised are used to fund and develop operations rather exclusively pay out all the investors.

Remember Theranos?

Elizabeth Holmes was very successful in securing funding from investors, but it was later discovered that she had lied about the technology and business transactions of her company.

Few investors made money in the deal with Holmes by the way, before it all went Kaput.

Similarly, Trevor Milton of Nikola Made millions of dollars for himself and early investors before ending up in jail

Normally Economics dictate the allocation of resources as per demand and supply . but these zombie companies create an economy of Misallocated resources.

Ola rides are cheaper than normal taxis in India, but will you take those rides if they were 100% more expensive. ? For some of you, the answer will be no . The reason is that operating expenses for these rides are not paid for by the consumers, what this means indirectly investors are paying upto 30 % of your fare for you .

The product that is only used just because it is heavily compensated probably shouldn’t exist in regular market . This creates a what people in economics call as dead weight loss. Right now that burden is being taken care by the VC funds .

Why would investors go for these business. ?

Well, the answer is that growth based business are a more stable form of madness, if for example a tata group company loses thousand crores in a quarter it is a corporate emergency ,if Swiggy loses 1 thousand crores it just another startup making losses or it is the cost of doing business. Profit less companies are more resilient to shocks of economic downturns , for starters their shareholders don’t get anxious by quarterly loses, because that’s just an expectation. What more is that these kind companies can have their game plan accelerated by crisis. As long as funding is plenty these business don’t have the same Risk of going under unlike traditional profit making companies.

The goal for lot of these business is to get market share, nothing more or less.

The idea of investing in companies that don’t create cash flows seems like a foolish thing , but it is reality , it is here and it has become important in our financial markets, What does world become when most of these companies are on the stock markets making losses ?

Hopefully these firms will become cash generating, until then it is difficult to see a happy ending .

Written By: Ankur Kushwaha, Sr. Consultant, Invest Punjab | Govt. of Punjab.

DISCLAIMER: Views expressed are personal.