These days, states and countries are taking proactive steps to attract foreign direct investment to their homeland. It’s common to come across large advertisements from state and central governments in leading newspapers in India, all geared towards promoting investment opportunities. Additionally, it has become customary to see ambassadors from various countries attending a variety of events in India. Their presence has almost become a benchmark for the success of these lavish events organized by the government. Another noticeable trend is the emergence of numerous consulting firms acting as “knowledge providers” or partners for state and central governments, aiding them in targeting investors from other countries.

So, how does one go about targeting a specific country for investment? What are the key factors to consider when trying to understand a target country, and how can we develop a framework to guide this process using reliable and financially sound information?

Central bank data, encompassing crucial indicators such as the current account deficit, trade surplus, and capital account details, serve as an invaluable tool for dissecting key points within industries, geographical locations, and supply chains. These indicators offer insights into the health of a nation’s economy and its interactions within the global market landscape. For instance, a trade surplus might highlight a country’s strength in certain industries, indicating its competitive advantage in exports. Conversely, a current account deficit could signal reliance on imports, shedding light on areas where domestic industries may need improvement or where supply chains are vulnerable. Understanding these dynamics can inform strategic decisions for businesses, policymakers, and investors, facilitating better allocation of resources and fostering stronger economic partnerships between nations. Moreover, it provides an opportunity for countries to identify potential roles within foreign supply chains, fostering collaboration and enhancing global economicintegration. Thus, central bank data serves not only as a barometer of economic health but also as a roadmap for navigating the complexities of the global economy.

Balance sheet of the Bank of Japan: Balance of Payment Account –

To understand the economic position of any country, it’s essential to grasp the concept of the balance of payments, a fundamental aspect of global trade and commerce. Countries engaged in international trade typically have two primary accounts: the Current Account and the Capital/Financial Account.

Trade Outflow: This refers to the goods and services a country exports from its shores. These are products produced within the country and shipped to other nations. Countries engage in trade outflow when they possess a comparative advantage in producing certain goods or services, making it profitable to export them.

Trade Inflow: Conversely, trade inflow involves the goods and services a country imports to its shores. These are products produced in other countries and brought in because the importing country lacks a comparative advantage in producing them domestically.

Current Account Deficit: The difference between trade outflow and trade inflow broadly represents the nation’s current account deficit for a particular year, excluding any remittances received from other countries.

A country’s balance of payments is influenced by its trade activities, with trade outflow representing exports and trade inflow representing imports. Understanding these dynamics helps assess a country’s economic position and its engagement with the global economy.

Capital Account / Financial Account: The Capital Account or Financial Account serves as the counterpart to the current account balance of any country. In the event of a combined trade surplus, the government faces two main options: borrowing money from outside the country or engaging in fixed capital formation using foreign exchange from other countries.

When the capital account and current account balances don’t align, it can lead to depreciation of the local currency. To counteract this depreciation, the central bank may opt to increase interest rates. Alternatively, the central government may temporarily increase its spending to stabilize the currency’s value. These measures aim to restore equilibrium between the capital account and the current account, ensuring stability in the country’s financial system and currency valuation.

How do these concepts aid in comprehending a country’s potential for attracting investments to your state or country?

To illustrate this, let’s consider Japan as a case study.

Current Account surplus ( Deficit ) with Japan :

When examining India’s exports to Japan, we discover that organic chemicals rank as the primary commodity. Approximately $700 million worth of these commodities are utilized by downstream industries.

This prompts the question: where are these chemicals being utilized? Primarily, these chemicals find extensive use in the pharmaceuticals and chemicals sector.

Moving on to the next significant category of imported commodities: electrical and electronic equipment. Let’s delve into the specifics of these commodities below.

So, where do these commodity products find their usage? In Japan, many electronic companies incorporate these small electronic components into their consumer durables. Brands such as Hitachi, Toshiba, Panasonic, and others rely on these components for their products.

As for the remaining major exports, such as pearls, oils, fish, and other aquatic invertebrates, they are primarily consumed and do not contribute significantly to further value addition.

What does it all add upto ?

When analyzing trade data, particularly exports from India, it becomes evident that these exports play a role in the supply chain of various industries. For instance, the pharmaceutical industry, chemical industry, and consumer durables sector are among those that could potentially benefit from downstream Foreign Direct Investment (FDI) opportunities for your state or country.

However, it’s essential to carefully consider other variables such as the addressable market size, market concentration, and FDI regulations applicable to these potential downstream industries. Simply examining the exports from your country can reveal where your state or country stands in the supply chain if the industry operates within a global supply chain.

Now look at the trade outflow –

Likewise, examining the trade outflow from Japan to India allows for an analysis of which exports from Japan are positioned within the global supply chain, whether they are upstream or downstream. Subsequently, it becomes imperative to delve into the pertinent rules and regulations, along with other business variables, to comprehend the potential upstream or downstream implications.

Financial Account / Capital Account – To stabilize the Current account of any country while preventing currency depreciation, it’s essential to effectively manage the capital account. What comprises the capital account?

The capital account, as the name implies, encompasses the following:

- Foreign portfolio investments.

- Fixed Capital Formation resulting from foreign currency inflows.

- Assets acquired by the host country in foreign locations.

- Borrowing by the local government in foreign currency.

- Lending by the local government to foreign buyers.

Country Level : So, how can this collection of databases be utilized to attract Direct Investment to your country? Point number 3 provides a comprehensive understanding of where direct fixed capital formation is occurring. For instance, consider Japan as an illustration.

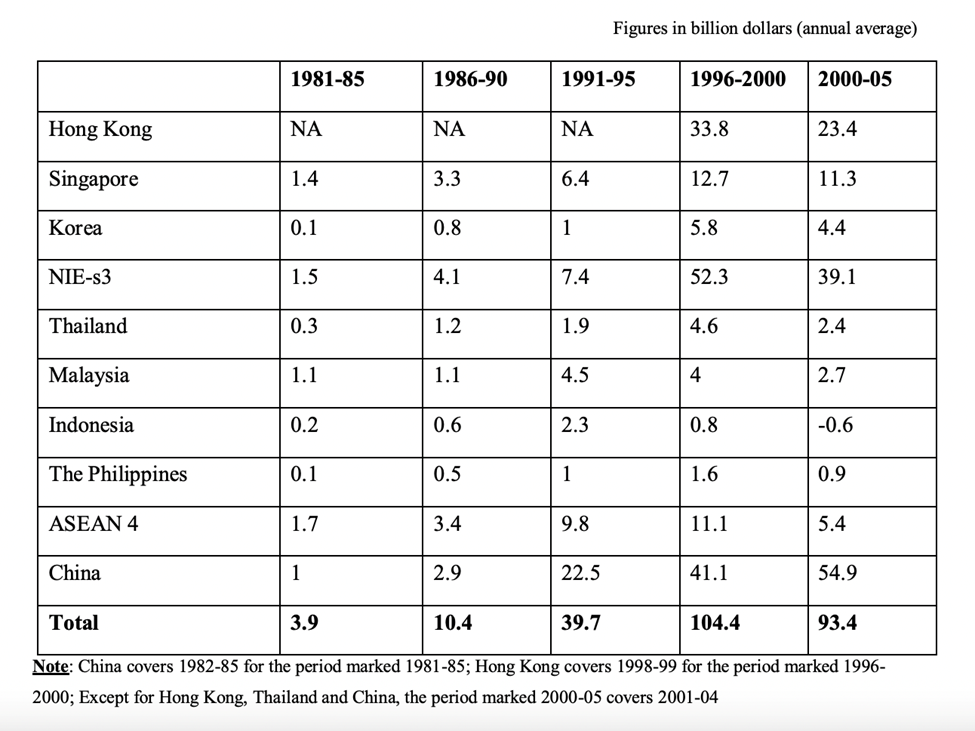

( Source: Bank of Japan )

The table above provides insight into where Gross capital formation is occurring utilizing the Japanese yen. It indicates the countries receiving the highest investments from Japan.

Industry or Sector Level : For deeper analysis, you can explore the sectors and industries into which Japanese yen is flowing into your country on a year-on-year basis. For instance, examining the following data will provide some insight into where Japanese yen has been directed in the past few years.

Source : Ministry of Commerce & Industry, India

This aids in comprehending the industries to prioritize for your country or state, facilitating the identification of potential synergies among these sectors. It also assists in determining what your country or state can offer in terms of resources or opportunities.

Company or Establishment Level :

If ones wants to dig further and see where the companies from these sectors are based in India, one can find that location-based data from Trade & Commerce Ministry of the specific country . For example, in case of Japan Organization like JETRO or JICA could be used for gathering that sort of Data .

Source: Japan International Cooperation Agency

One can further dig up data to find trends as far establishment of business is happening or has happening in past years .

Source : Ministry of Trade and commerce, India & Japan External Trade organization

The above data can give you trends and insights in finding what is going where and why.

Bottom Line :

In conclusion, the convergence of macroeconomics, international trade policies, central bank strategies, and import-export dynamics serves as a potent framework for attracting Foreign Direct Investment (FDI) to a country.

Written By: Ankur Kushwaha, Sr. Consultant, Invest Punjab | Govt. of Punjab.

DISCLAIMER: Views expressed are personal.